Asia currently dominates automotive lithium-ion cell production – it controls around 79% of the market. However, a recent report by the DOE’s Clean Energy Manufacturing Analysis Center (CEMAC) found that the US has a growing opportunity in the industry, which is expected to swell from the current $9 billion to $14.3 billion by 2020.

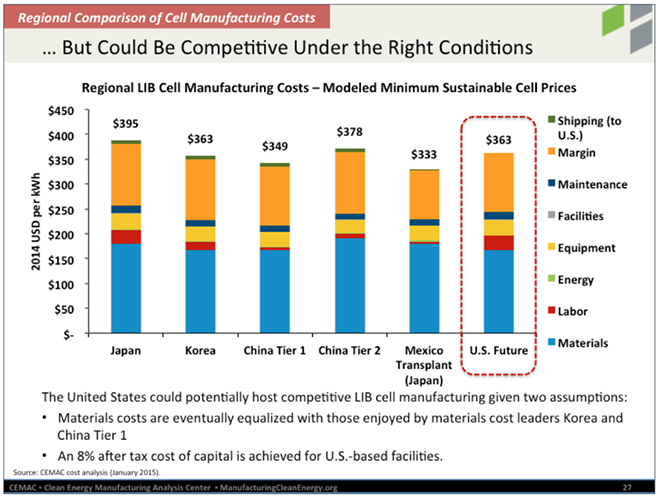

The CEMAC analysis found that competitive opportunities for automotive lithium-ion battery (LIB) cell manufacturing are mostly created, and are not inherent to specific regions. However, established LIB competitors have a huge advantage due to production expertise, supply chain optimization, and existing partnerships.

Japan, Korea, and China benefit from a significant population of key suppliers (for electrodes, separators, electrolytes, etc), while the US has a relatively immature supply chain, and most US cell and battery plant operators are relatively new to the industry.

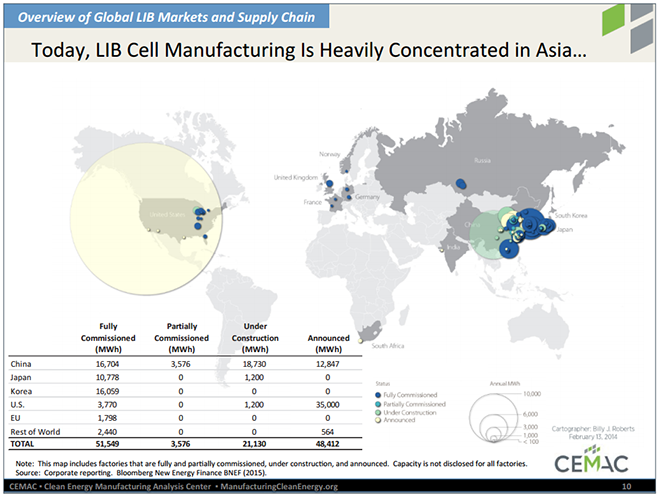

LIB cell manufacturing in the US currently amounts to around 3,770 MWh, or 7.3% of the global total. However, there is another 1,200 MWh under construction and 35,000 MWh (Tesla’s Gigafactory) announced. If all this capacity is fully realized, the US will have a total of 39,970 MWh, or 32% of the global market.

In all regions, automotive LIB capacity far exceeds production – global average utilization is estimated at 22% as of the beginning of 2014. However, if moderate demand estimates are met, supply and demand should come roughly into balance around 2017-2018.

“US cell producers appear to be disadvantaged in the current market, but the United States could become competitive in parts of the value chain with high potential value,†reads the report. “Cells represent 27% of the value added in complete automotive LIB packs, but 34% of the value added comes from electrodes and other processed materials, an area where the United States could possibly compete. The United States already assembles cells into battery packs for EVs manufactured domestically, which comprises 39% of total LIB pack value.â€

The report notes that technological advancements currently under development by the DOE and its private-sector partners have a lot of potential to boost automotive LIB manufacturing in the US by reducing battery cost, enabling more people to purchase EVs.

Source: ChargedEVs