Q&A with LG Chem Power’s CEO: Dr. Prabhakar Patil on how the company became a Li-ion battery front-runner, the economics of building batteries, and why it spends little energy on what comes after lithium.

Among Tier 1 automotive suppliers of lithium-ion cells, LG Chem is off to a clear lead, based on the number of announced and rumored supply agreements. GM, Ford, Volkswagen, Audi, Daimler, Volvo, Hyundai, Renault and others have publicly announced deals to use the Korean chemical company’s products in production plug-in vehicles.

Thanks to the large battery packs in the Tesla Model S and Nissan LEAF, Panasonic and AESC (a Nissan and NEC joint venture) edge out LG in terms of installed battery capacity currently on the road. But that could change soon as more and more planned vehicles hit production. In fact, Nissan’s CEO has stated that the company is not opposed to working with cell suppliers like LG Chem, instead of producing its own cells, if the economics make sense. In the battery-powered vehicle business, continually driving down costs is critical to long-term success.

Charged recently caught up with Dr. Prabhakar Patil, CEO of LG Chem Power Inc, to get his take on the advanced battery industry.

Charged: What’s your secret? How has LG Chem been able to secure so many contracts with big automakers?

Dr. Prabhakar Patil: We are the only battery company that’s chemicals- and materials-based. Most of the others are electronics companies that have gone into the battery space. The critical factor for batteries is materials. Getting to cost competitiveness is not just a question of scale or reduction in material costs, it’s also about improving the characteristics of the materials. That’s what we do well, and at the same time, we have the economies of scale.

The Chevrolet Volt is a good example of how materials expertise plays a role. When we did the first generation, the goal was about 40 miles of electric range, and at 200 Wh/mile, that’s 8 kWh. But the installed capacity of the first generation is 16 kWh, because we allowed for 30% degradation over 10 years of life, and it only uses about 70% of the capacity window. If you put those two factors together, you get about 50%, so you start with 16 kWh of nominal capacity at the beginning of life.

However, if through better materials engineering you can improve the battery’s capacity retention over life and the useful capacity window, without degrading the performance of the cell, then you have a way to reduce the cost of the battery simply by reducing the number of kWh you’re putting in at the beginning of life.

Our parent company in Korea has over 400 engineers working on these projects, and that’s what it really takes – looking at every single aspect of the materials that go into making these cells.

Frankly, the time scale that we’ve been able to improve all of these characteristics has surprised me. Within a period of seven to eight years – from 2010 to 2017 or 18, when we can see our way to a 200-mile BEV for about $30,000 – it’s close to a factor of two reduction in cost in terms of dollars per kWh. There is not one thing you can point to and say, “That’s what the breakthrough was,†but it’s a combination of several things.

When GM first announced the requirements for the Volt in Dec 2006, I remember very clearly thinking, “Nobody can do this. Nobody has this battery technology. You can either meet the energy density or you can meet the power, but there is no cell in existence that can do both.â€

Then we kind of jumped in with both feet along with GM to make it happen. To have that kind of a partnership with different OEMs has also helped, because another part of it is understanding the usage patterns and the usage profiles, and translating it into what it means from a cell perspective. To optimize what we can do on the cell side, we need the experience and expertise of how things get used in the real world by the customers.

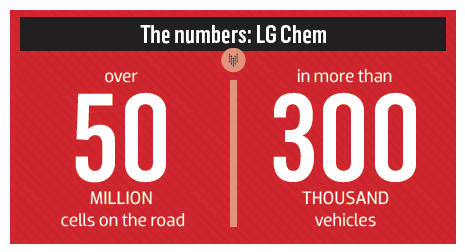

So, it’s a materials-based technology, and it’s being able to do high-volume manufacturing without losing quality and reliability. We have over 50 million cells on the road in more than 300,000 vehicles with what would be considered pharmaceutical-grade quality and reliability. Another thing that’s very critical to the vehicle manufacturers is not having any incidents that will tarnish the whole industry and the battery technology. That’s why I was very concerned when I heard reports about battery incidents on passenger jetliners. To me, that didn’t need to happen. If you know what you’re doing with lithium-ion batteries, they can be very safe.

Charged: What’s the biggest misconception about Li-ion batteries in vehicles?

Dr. Patil: The term lithium-ion makes many people think it’s just one thing, but there are so many flavors. One way to classify them is by the power-to-energy ratio.

If you look at, for example, a non-plug-in hybrid, the battery typically provides half the power that the vehicle needs, because the other half comes from the engine. Yet the range, which is the energy of the battery, is usually less than five miles.

For plug-in hybrids the power requirement goes up by a factor of two, because you operate in a pure electric mode with no help from the engine. But the range, or the energy requirement, can go up by a factor of 20 to 40 miles or more. So the power-to-energy ratio actually drops by a factor of 10.

And now if you get to pure electric vehicles, the power stays the same because you don’t need any more performance. Yet the range goes up by another factor of four or five.

So you get about a factor of 100 difference in power-to-energy ratio between what would be an extended-range EV and a hybrid, or a micro-hybrid. No single chemistry is going to reach all those requirements. So, one of the things we do is customize, or optimize, for the particular application. That’s one of the advantages, again, of being a materials company.

Charged: How much time do you spend thinking about the next-generation battery technology, beyond lithium?

Dr. Patil: Not very much. The reason is pretty simple – it’s basic chemistry. Lithium is the third-lightest element, and the lightest metal.

The only thing that’s lighter is hydrogen, but as a gas it’s very difficult to work with because you cannot move it around. You lose a lot of it if you try to pipe it. If you try to use it as a liquid you lose a lot of the energy advantage. And helium is inert.

So, lithium is the next best thing for batteries and it will remain lithium in some form for a long time. There could be a future in lithium-metal batteries, like you hear some people talking about, or some other variant. Lithium is very effective in terms of being energy-efficient both from a volume and a mass basis.

Right now, there is a lot of focus on improving the cathode, because that’s sort of the limiting factor. But as you improve the cathode, the anode sooner or later will become the problem, and that’s why people are looking at the silicon type of anode. These improvements will continue to happen, and they won’t be in one huge step. There will be enough smaller steps added together that when you stand back, you will see a large reduction in costs.

Charged: So you spend most of your energy focusing on driving out costs?

Dr. Patil: Correct, I focus on creating a better value equation. Cost is the denominator and the numerator is the performance, or the utility, whether in terms of life, energy density, or whatever. The emphasis is different depending on what you’re trying to design – a BEV, a hybrid, etc.

Charged: At some point, driving out costs will come down to finding more efficient ways to get the raw materials, correct? How far away are we from that point?

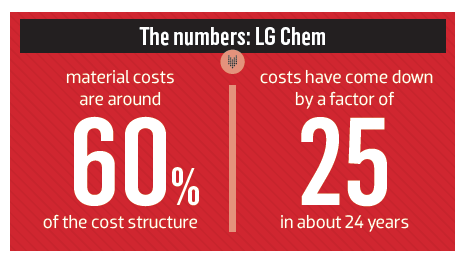

Dr. Patil: Yes, but we’re not quite there. There are still more engineering improvements that can be made. Not as much in manufacturing, because if you look at the cost structure of cells, somewhere around 60% of costs are related to material costs. That’s material costs for the cell manufacturer as purchased material. Some of that is driven by economies of scale and by the performance characteristics of the material.

I think there is quite a bit to be gained in terms of reducing the net material costs, while getting the same performance out of the cell, through better engineering, customizing of the materials, tweaking their properties and so forth.

Charged: Some say that a cost target of $125/kWh at the pack level is needed for cost parity with ICEs. Estimates put most of the current generation vehicles at around $400/kWh and Tesla at around $240/kWh. Is $125/kWh in the foreseeable future?

Dr. Patil: In terms of being able to get to that level, I’m not sure exactly what the timeframe would be. If you look at it from the historical perspective, the first commercialized Li-ion cell was back in 1991 at Sony. In about 24 years, the cost has come down by a factor of 25 or more on a dollar-per-kWh basis.

The silicon industry is used to this type of drop, but it’s unheard-of in a battery type of technology. And the trend continues. It’s in incremental changes, but when you look at it over the span of 5 to 10 years it will look pretty significant.

Charged: The Chevrolet Bolt was unveiled in January 2015, but the goal of a 200-mile EV for around $30,000 was discussed by GM executives as early as 2013. Were you surprised by these specs, similar to when you first heard the Volt being openly discussed?

Dr. Patil: We have worked closely with GM on the Volt from the start. As a result, we have been deeply engaged in the development goals for Li-ion batteries in general and the Volt in particular.

We also recognize that battery costs have to keep coming down in order for this technology to become mainstream. We can’t take what I would call a self-centered kind of perspective that says, “I have to have my margins, therefore it’s better for me to have a higher battery price.â€

We have to realize that the name of the game, at this point, is growing the volume of vehicles. And the only way that’s going to grow is if customers see a value equation that makes sense to them. So, we will do whatever we can to go down that cost curve as fast as possible.

Charged: The second generation Volt has 192 cells versus 288 in the first generation, both supplied by LG Chem. Can you explain the strategy of using larger-capacity cells?

Dr. Patil: That’s another trend that we’re pushing for. When you can cut down on the number of cells by putting additional capacity in the cell, it reduces the overhead at the pack level. Because the fewer cells you have to take care of from a mechanical longevity or battery management system point of view, the better off you are.

Charged: Sometimes we hear battery engineers say they’d hate to be a cell maker because of the competition and the demands of the OEMs. What do you think about that idea?

Dr. Patil: That’s true. There is a lot of overcapacity in the market. Part of it is what I call a toxic side effect of the government incentives that were put in place. However, I have to say that the government incentives are and were a good thing. Without them, we’d still be talking about why the US is not competitive in these advanced technologies. Whenever you have a lot of government or venture funding, there are new challenges. We do have overcapacity in the US, but it’s going to straighten itself out over time.

Nobody knows exactly where the tipping point is – maybe it’s the 200-mile vehicle for around $30,000, or maybe it is what’s happening in the PHEV or micro-hybrid space. It’s all going to continue to grow the demand for lithium-ion batteries. I think the capacity rationalization will happen. And it was good the way we got here, because if the government had done nothing and waited for the demand to grow, we would still be waiting. We recognize that is the period that you have to keep your eye on the long-term proposition.

Charged: LG Chem’s Michigan plant is said to be operating at about 25 to 30% of capacity. Do you see that increasing soon?

Dr. Patil: Today our cells are produced in both Korea and the US. The challenge is the overall capacity – you have to do a balancing act in terms of the demand versus the capacity you have.

The good part is that we have now demonstrated that you can make cells as cost-effectively in the US as you can make them in Korea. There is always a US manufacturing issue people talk about, that you can’t really do cost-effective, or efficient, manufacturing in the US. But that’s kind of a myth that we have disproven with data. Recently, we’ve shown that you can make cells here or in Korea and not have a concern related to yield, cost efficiency, quality, etc. So now it simply becomes a matter of what is the best way for us to use the capacity that’s in place.

Charged: Most of the automakers appear to be relying on suppliers to manufacture cells, but Tesla and Nissan have taken a much more hands-on approach. What do you think of their strategies?

Dr. Patil: It’s a difference of histories, to some extent. Nissan was actually one of the first companies to work with Li-ion. So, they have had a lot of internal capability. Many people don’t remember, but Nissan had hybrid programs back in the 1990s. They did a limited production that used lithium-ion batteries that were internally developed. So, there was a lot of internal capability in place.

However, I think it ultimately comes down to costs, and that’s why you see the statements from executives saying, “even with internal capability, if someone can deliver a more cost-effective solution, by all means, we’ll go there.â€

Tesla has a somewhat different philosophy. They’re a much more vertically integrated company. But there again, it’ll depend on the cost-effectiveness of trying to do it all in-house versus trying to get it from the outside.

I think the other OEMs have recognized that this is such an investment-intensive business because of the R&D that it takes. You have to continue to invest in the manufacturing capability, and they cannot justify the scale on their own to put in that kind of investment. Particularly when they have a credible supplier with a good relationship.

So, I see a trend of OEMs continuing to come to companies like us to be their supplier for batteries.

Charged: The other Li-ion market that’s poised for explosive growth is large-scale energy storage. Where do you think that fits in?

Dr. Patil: I think it will be as big, or bigger, than the automotive market. A few years ago, Li-ion was dominated by consumer electronics (CE) – cell phones and laptops. I think by the 2020 time frame, the automotive market will match or maybe be bigger than CE. The current total installed capacity of the consumer electronics market is maybe 25 GWh. To give you an idea of scale, Tesla says its Gigafactory alone will be at 35 GWh of annual capacity by 2020.

For the storage market, we have the largest install in North America at the Tehachapi Energy Storage Project in southern California – 32 MWh of batteries for wind farm support. The market is slow to develop because of the size of the installations and the cautiousness of utilities. But I think as soon as it turns the corner, the large size of the installs will play to make it a very big segment.

Charged: Do you think there will be a large role for secondary-use batteries that come out of used vehicles and go into grid storage projects?

Dr. Patil: That is a value proposition that we’re actively looking at. At the end of vehicle life, lithium-ion batteries still have capacity three times that of a brand new lead-acid. It could be a good proposition, but there are some challenges from an economic point of view. Yes, you have 70% of the energy left that you can use, but in the meantime the cost of the new batteries over the 10-year lifespan [of the secondary-use batteries] may have dropped by a factor of two or more. So, where does it make economic sense, to use a new battery that may be significantly lower in cost, or capture the residual value left in the used battery?

Either way I think it’s very feasible. The main obstacle for me for secondary usage is standardization, because you don’t want to do a lot of remanufacturing. You want to be able to just pull the packs out of the vehicles and connect them together. We’re not quite there yet in terms of the standards. But there are active projects going on.

Source: ChargedEVs