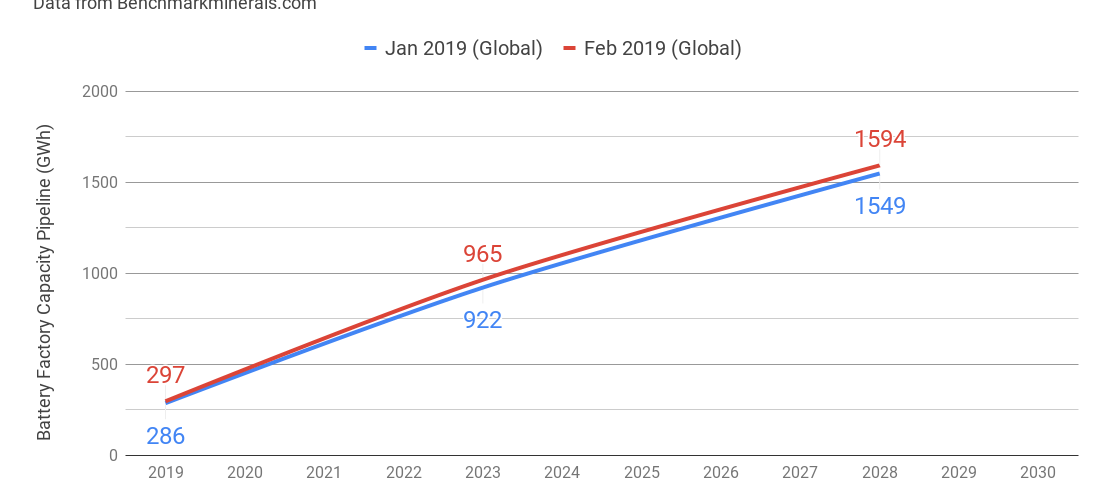

Another month passes, another 43 GWh of battery factory capacity is brought into the planning pipeline for production in 2023, adding over 4% to the global total, in just a single month (50% annualized growth).

Planned annual output by 2023 will soon cross 1,000 GWh of capacity, with over two-thirds of it in China. That’s enough to supply annual production of over 13 million EVs in China alone.

Keeping month-by-month score for total additional plans announced, February’s Lithium Ion Megafactory Assessment from Benchmark Minerals records substantial increases to the pipeline for battery production capacity. The planned annual production capacity being brought online by 2023 rose from January’s score of 922 GWh, to 964 GWh by the end of February. That’s over 4% additional planned capacity arriving over the course of a single month.

At this rate, sometime in the next couple of months, the planned 2023 production capacity will likely cross 1,000 GWh. That’s equivalent to meeting the annual production needs for 20 million EVs with an average battery size of 50 kWh each.

The announcements of more battery Gigafactories will not stop there. We’ve recently seen that the timeline from initial planning of a large-scale facility to production output can be remarkably short, with Tesla’s Shanghai Gigafactory going from provisional announcement (mid 2018) and site confirmation (late 2018) to initial production (planned for Q3 2019) in around a year. Although battery cells (and packs) will not be made onsite this year, they will be in the longer term. The point is that — with a possible timeline as low as 2–3 years to go from planning to potential cell output — more battery factory production capacity can potentially yet be brought online for output by 2022 or 2023, especially in China.

Middle Kingdom frontrunners CATL and BYD stand alongside Tesla in knowing how to roll out battery factory facilities relatively quickly, and there are a large number of smaller players jumping into the battery production space also.

The growth in battery production will enable even more EVs to be produced in China, and I’ve recently predicted that EV market share in the country is on track to reach 50% by 2025. Let’s have a look at the latest graph for what will be possible in 2023–2028 (we assume average pack size of 50 kWh across all BEV/PHEV classes):

As we stand today, the planned battery capacity in China will enable annual production of over 13 million EVs by 2023, 16.5 million by 2025, and 21 million by 2028. As mentioned above, it’s almost inevitable that planned capacity will increase further between now and these dates, not just in China, but globally.

Benchmark Mineral Intelligence has very comprehensive regular monthly global assessments (of battery capacity, lithium supply and pricing, and many other key areas of the battery supply chain), of great value for any business working in this area. They are kind enough to pass me press copies of their reports so that I can share their headline findings with our readers.

Source: Cleantechnica