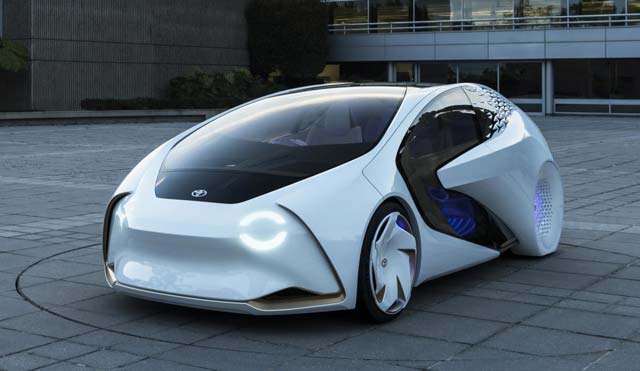

Toyota has been slow out of the gate in the race to build cars with plugs, preferring to rest on its laurels as the first company to sell conventional hybrid cars in large quantities. Other than that, it has cast its lot with fuel cell technology, managing to sell hundreds of its Mirai hydrogen powered sedans worldwide in the past few years. And then there’s this thing:

But Toyota is in danger of being left behind as the electric car revolution gathers momentum, particularly in China and other world markets. And so, it has formed a joint venture with Panasonic to manufacture EV batteries. Toyota will own 51% of the new business and Panasonic the remaining 49%. Panasonic will transfer ownership of five battery manufacturing facilities in China and Japan to the new entity, but the deal will not affect its partnership with Tesla in Nevada.

According to Nikkei Asian Review, the total amount of battery capacity from the new venture will be 50 times greater than what Toyota now uses for its standard hybrid vehicles. The expectation is that such an expanded capacity will dramatically reduce the per unit cost of the batteries.

The JV will supply batteries to Mazda as well, which is partnering with Toyota on EV technology, along with Toyota subsidiaries Daihatsu and Subaru. Honda currently uses Panasonic battery cells in its hybrid projects and will also benefit from the new combined manufacturing arrangement.

The two companies will also cooperate in developing next-generation solid-state batteries which are expected to boost the range of electric cars at lower cost than today’s lithium-ion batteries. They have been working together on solid-state technologies since 2017. One of the perceived advantages of solid-state batteries is they have no liquid electrolyte that can catch fire in rare instances.

Toyota plans to triple its annual sales of electrified vehicles — a term that includes conventional hybrids — to 5.5 million by 2030, but lower battery prices are essential to reaching that goal. The new business relationship is expected to help bring less expensive batteries to market and spread the development costs across a wider business model. The link up between the two companies may also allow them to compete more effectively for scarce raw materials as the demand for batteries increases globally.

Does any of this mean Toyota has turned away from its fixation on fuel cell vehicles at long last? Not necessarily, but it does indicate a course correction that could lean in that direction in the near future.

Source: Cleantechnica