We see you to, in the 2023, the new percentage of banking companies which get alongside otherwise surpass the limit grows from.7 percent inside 2022 to more than 4 percent while in the 2023. Also, this type of banking companies change from holding to eleven percent from total mutual places to around 40 percent. Outflows of commercial, riches government, and you can noninterest-results deposits proceeded to push put declines in the 1st one-fourth from 2023.

Indie theatre The brand new Projector usually resume screenings from the Wonderful Kilometer Tower within the August

Hard rock Wager will bring an easy on line sports betting program, which supplies a thin directory of gambling possibilities on the really well-known activities. Financial is not difficult and you can simple at the Hard rock Sportsbook, that’s based on the overarching ethos of this activities gambling website. You have got a pretty thin set of banking options for playing, however they are all the simpler. The newest applicant recorded travelling, translation and legalisation invoices, timesheets and you may invoices to own legal services before Court. The brand new home-based courts don’t establish Italy since the boy’s chronic house ahead of removal and focused simply for the their integration on the Republic out of Moldova following the removing.

He registered that the boy got abducted since the none the guy, nor the new Italian boy protection court, got approved the child’s transform out of household away from Italy to the Republic out of Moldova. The guy argued that the courtroom got did not gauge the causes as to the reasons the new Italian process of law got deprived Ms Yards. “Developments inside chance sensitiveness and feel brought by offer is estimated to result in an enthusiastic aggregate 16percent boost in common collateral level step 1 financing conditions,” the newest regulators told you inside a fact sheet. Level step one preferred funding account size a keen institution’s thought financial energy and its own barrier against recessions otherwise trading blowups. The alterations tend to generally improve the quantity of investment one financial institutions have to look after facing you can loss, dependent on for each company’s chance profile, the fresh firms said. As the increased conditions affect the banking companies with no less than 100 billion inside the property, the changes are needed in order to impact the greatest and more than complex financial institutions more, they said.

What is a great Brokered Cd?

Each other shell out a set rate of interest that is basically higher than a consistent savings account. They are both debt mrbetlogin.com my link burden out of an giving bank and you can each other pay off their prominent with attention whenever they’re kept to help you maturity . More important, they are both FDIC-insured as much as 250,100 (per account proprietor, for every issuer), a security restriction that was produced permanent in 2010. To find the best Computer game prices, i on a regular basis questionnaire Cd products on the banks and credit unions you to definitely continually provide the most competitive Cd prices.

Delinquency Rates Is actually Lowest however, Ascending

Ascending Financial is the on the internet division away from Midwest BankCentre, a good St. Louis, Missouri people financial. With regards to Cds, it has terminology anywhere between six months and three-years, and also the smaller terminology earn highly aggressive APYs. Such as, its you to-season Video game punishment is much like just what additional banks provides and that is below other banks’ commission for the early withdrawals. It would appear that technical improvements can be explain some of the increase inside the speed, but high develops within the price almost certainly only apply at household and business depositors. Big firms, which were the new widespread source of deposit withdrawals inside prior work at symptoms in the largest banks, already could actually withdraw fund inside the an automated electronic manner while the late 1970s.

Stability research begins for 5 extra applicants to possess courtroom in the Central Legal away from Attention

- Official Committee on the Multidistrict Legal actions (JPML) so you can consolidate the bad earplug circumstances to at least one federal courtroom for paired pretrial procedures.

- Its worldwide investigation linkages was such complex for its attention to accentuate using its to another country workplace inside Brussels (Branscomb, 1983, p. 1005).

- People must look into the newest the amount that other profile, deposits otherwise accumulated desire will get go beyond applicable FDIC limits.

- It is the advanced-measurements of financial institutions you to secure the very mutual places.

Even if Computer game rates peaked from the fourth one-fourth out of 2023 to possess the major you to definitely-season and four-seasons Dvds in the current rate stage, aggressive Cd cost continue to be more than the brand new national mediocre Video game cost. What’s far more, high-producing Video game cost always outpace the pace from rising cost of living. Examining accounts are best for people that need to remain their money safe if you are nevertheless having simple, day-to-date usage of their money. Within the the fresh laws, believe deposits are in reality limited to 1.twenty-five million inside the FDIC exposure for every believe proprietor for each insured depository institution. FDIC insurance policies fundamentally covers 250,100 for every depositor, for each bank, in the for each and every membership ownership class. It actually was updated on the April 10, 2025, to correct title of your own bankers class regarding the American Financial Association on the American Lenders Organization.

Modified procedures to own posting analysis accounts pursuant to help you a great governing from the the brand new Constitutional Legal

- Rather, it developed in the fresh 1960s and you can seventies in order for banking companies to locate time dumps, such as, Dvds, from outside their particular market as well as depositors to locate large costs.

- That it limitless insurance rates try short term and will stay-in feeling whatsoever FDIC-insured depository establishments due to December 29, 2012.

- Such, if an individual had in initial deposit membership having an equilibrium out of 600,100, only 250,100 of those financing, the standard restriction per membership insured by the Federal Put Insurance policies Corporation (FDIC), might possibly be covered in case your bank failed.

- Stand told from the today’s higher Video game output and you may exactly what financial institutions and you may borrowing unions offer them.

Silvergate individually revealed you to definitely FTX got taken into account “below tenpercent” of its deposits for the Sept. 31, 2022. Whenever we think that “below tenpercent” mode 9percent, up coming FTX deposits was on the step 1.step 1 billion, implying you to definitely average DA dumps up to Nov. 15 had been 10.9 billion. These types of data indicate average DA dumps just after Nov. 15 have been up to step three.7 billion, as much as the same as the brand new one-fourth-prevent contour from step three.8 billion, implying the fresh work with had been accomplished because of the The fall of. 15. Energetic December 30, 2010 all the noninterest-affect exchange put membership is totally insured for the entire count on the put account.

In reality, the newest drama at the Continental Illinois back in 1984 try described as a great international “super punctual digital work at” (Sprague, 1986, p. 149). By 2008 and you may indeed because of the 2023, technological advances incorporated extension of digital financial to small businesses and houses and you will method of getting online banking everywhere due to cellphones alternatively than just in the dedicated pc terminals. For example enhances almost certainly sped up of a lot deposit withdrawals by a number of instances otherwise a couple of days compared to calls, faxes, or perhaps in-person banking. However, nothing regarding the historical checklist means depositors in 1984 and 2008 waited a few days making distributions on account of scientific constraints.

3M could have been stating all with each other these states is going to be fixed inside case of bankruptcy courtroom. Plaintiffs had been stating all the collectively they need a good settlement. We are revealing the us government builder security since this litigation first started. That it defense is based on the concept that when government entities is actually protected of 3rd-team injury states related to a binding agreement, the us government specialist performing the government’s particular requests ought to be protected against court action.

It also shows and that kinds from banks make use of these deposits and you will as to the reasons. Its increased fool around with in the financial disorder out of 2023 means that which advancement will be utilized when the interest in covered dumps develops. The new widescale adoption out of reciprocal deposits provides ramifications on the effectiveness of your put insurance system you to definitely bear after that look. Banks’ forecasts in the second half out of 2022 conveyed a great decline credit mindset, and therefore led banking institutions to improve financing loss terms. Organizations were directly keeping track of their CRE profiles, particularly place of work exposures, for signs of stress. The degree of borrowing exposure within the office exposures has expanded in the midst of high rates, firmer financing standards, and a structural change in work industry because of functions at home and you can hybrid work options.

To the money calls, bank management groups quoted industrial a home while the a sector you to he or she is watching closely, particularly the workplace class. Large banks’ earnings in the first quarter away from 2023 exceeded 2022 membership. Aggregate bank profits, since the counted from the come back to the guarantee, calculated 13 percent in the 1st one-fourth away from 2023, in contrast to eleven per cent in the next one-fourth out of 2022 and you can 12 percent attained in the 1st quarter out of 2022. Online attention margins measure the difference in attention earnings and also the quantity of desire purchased financing, shown as the a percentage from average generating assets.

All of the state UI organizations and divisions is processing states and will backdate your own claim to when you turned into out of work, as outlined by you after you enter the last day’s work. You will need to generally contact these to update your unemployment time when the wrong to enable them to accurately spend retroactive pros. In this instance retroactive costs the eligible says registered previous on the states pandemic program involvement day will stay processed and you will repaid.

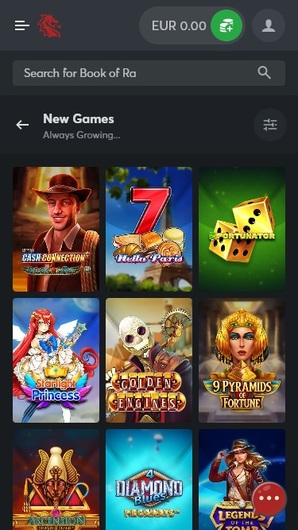

Isaac Tigrett and you will Peter Morton founded the business in the London back inside the 1979. The brand new Seminole Group out of Florida own it within the 2007, and difficult Material Around the world is now headquartered inside the Davie, Florida. There’s a number of props and futures wagers, but the list of gambling choices is extremely streamlined. There are no official playing limitations, however, relaxed participants try asked, and you will be able to put quick wagers. Big spenders can be contact the customer provider agency to see how far they are able to bet on specific football, online game and you can segments. Hard rock Bet will give you a lot fewer playing options than just their competitors.

During the time of these types of proceedings inside the Italy, to your 26 September 2017 Ms M. Got the little one on the Republic of Moldova and refused to go back. Time immemorial of the mandate, the fresh Judicial Vetting Commission has had 183 someone to own research, according to the around three laws and regulations ruling the brand new external research techniques. Ones, 60 men and women have possibly resigned otherwise taken of competitions, and cuatro have passed the newest pre-vetting techniques.