As automakers and cell manufacturers begin to realize the complexity of benchmarking new battery materials, Wildcat Discovery Technology is using its high-speed R&D technology to help find clarity

If you follow battery technology news on a regular basis as we do, it’s easy to get overwhelmed by the volume of new announcements. There are just so many “breakthrough” and “next-best-thing” claims about new battery materials and manufacturing techniques coming from academia and material suppliers.

It’s not only daunting for those of us who are trying to evaluate the credibility of press releases – the top scientists at the automakers and cell manufacturers also have a difficult time sorting through the facts to view these claims in an apples-to-apples comparison. Those whose job it is to evaluate these materials for commercialization are finding that this is extremely complex work, and most don’t have the bandwidth to test and compare them in a truly comprehensive and accurate way.

Now, many are looking for help from the battery chemistry and material science experts at one of the most unique companies in the industry: Wildcat Discovery Technologies. Wildcat has been at the forefront of battery research since its inception in late 2006. The company adapted high-throughput combinatorial chemistry techniques – processes that are well known for discovering new pharmaceuticals – and started using them to rapidly synthesize and evaluate energy-storage materials. The innovative group of scientists say they can build and test hundreds of batteries with new materials in the time standard labs might test just a few.

Wildcat recently told Charged that, while it still uses its techniques to help its customers discover new and novel materials, now its fastest-growing type of project is helping to benchmark and compare existing materials. “Five years ago we were trying to convince companies that we could help them with this type of valuable benchmarking R&D, but we didn’t really see much of a response,” explained Jon Jacobs, VP of Business Development at Wildcat. “The dynamic has recently changed, and many companies are beginning to see the value in this kind of fundamental benchmarking work. Increasingly, the amount of R&D resources required to rapidly evaluate new materials has become overwhelming for companies throughout the supply chain, – whether it’s a cathode, anode, electrolyte, or most importantly, combinations of these in a full cell.”

Automakers, consumer electronics companies and battery manufacturers are inundated with requests from suppliers to try new self-proclaimed great materials, but very few, if any, have the bandwidth to test and compare them in a truly comprehensive and accurate way.

At first glance, it may seem that the multi-billion-dollar car companies with thousands of engineers would be flush with resources to do this type of benchmarking, but in context, it’s clear that they are not. High-performance battery-powered EVs are brand-new in an industry with little historical precedent for quickly adopting new technology. When talking to most auto execs, there’s a sense of consensus that EVs will soon see an unprecedented increase in market share. And that realization has brought a blanket of angst and uncertainty about who will emerge as the leaders – both in terms of EV sales and in terms of fundamental technologies like the specific battery chemistries that are key to profitability.

While accurately benchmarking the potential of new battery materials may someday become a core competency of every automaker, today it is not.

The problem with drop-in replacement testing

Any engineer worth their weight in nickel knows that data sheets need to be independently verified, and that, typically, you can only compare products if each was tested in exactly the same way. However, making an apples-to-apples comparison of new battery materials is orders of magnitude more complicated than comparing traditional automotive parts from new suppliers.

“When a material supplier sends out new samples of its next-best-thing, customers want to drop it into their existing processes for evaluation,” said Jacobs. “They don’t really want to modify anything, because it’s difficult, time-consuming, and requires a fair amount of research resources. But simply dropping a new material into a full cell system often results in poor cell performance, causing some great new materials to get overlooked, and leaving material suppliers frustrated with negative feedback.”

“In other cases, the customer – usually a cell manufacturer or OEM – will try to evaluate as many variations of prototype cells as they can,” added Dee Strand, Chief Scientific Officer at Wildcat. “However, they don’t have ready access to all the different possibilities – for example, different additives or mixing methods – or the capability to create nearly as many variations as we do. So then they have to make a decision with incomplete data collection – they may not have a comprehensive or fair comparison of the new materials available.”

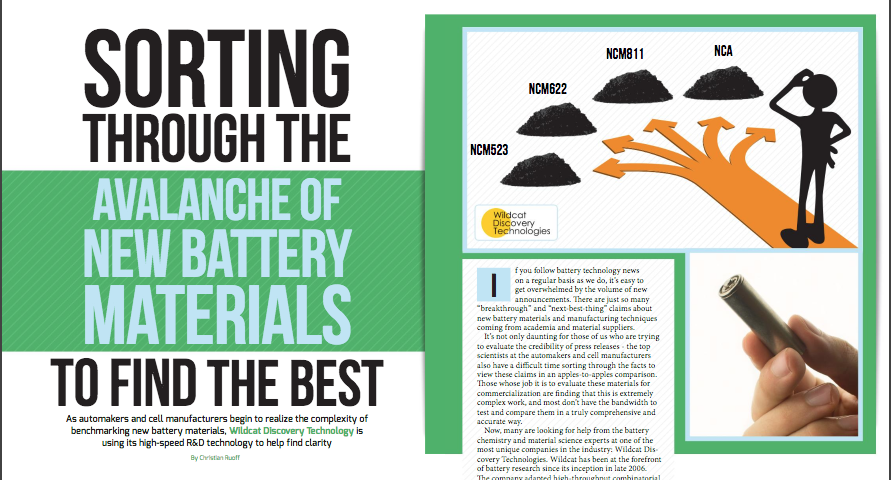

As an example, Wildcat recently began a project, in partnership with a major automaker, to optimize, evaluate and compare new cathode materials, using samples from nine of the world’s leading suppliers. Each of these suppliers has different developmental versions of its material, and, although the samples fall into the general category of a NCM material, they’re all quite different.

“They have different particle sizes, different morphologies, proprietary coatings on the particles,” explained Jacobs. “If you formulate them in an electrode recipe with the same binders and conductive carbon, some of them might perform well and others will not. But that’s not necessarily the fault of that base material – each needs to be optimized. So that’s the first thing that creates an immediate need for our type of high-throughput prototyping and testing. At a minimum, you’re going to want to test dozens, if not hundreds, of modified cells to give each base material supplied a fair chance to perform well. We often start off by formulating the base materials identically, and then, very quickly, each one will take a turn and get a unique set of other ingredients like conductive carbons and binders that allow these materials to perform at their best.”

“Also, the rheology might be different for the slurries,” added Stand, “so the process that you use to make a good coating for one material might not be the same as a process for another material. For example, with silicon anodes and the incorporation of nanoparticles in those, the processing is more challenging. And some of the more highly-conductive carbons – like graphene or carbon nanotubes – those high-surface-area materials can be challenging to deal with. Any time you vary the compositional recipe of what’s going into the electrode coating, you need to do a high-throughput screen on the process used to make that coating to ensure that you get a high-quality coating with Material A and a high-quality coating with Material B. Only then can you obtain a fair electrochemical performance comparison.”

Wildcat admits that when it started one project to evaluate different silicon anode materials, it assumed that silicon would be relatively robust in terms of the manufacturing process, like most electrode materials. “We found that if you change the base silicon anode material, most silicon formulations required some process optimization to get a good film,” said Jacobs. “If a company is waiting for silicon samples to arrive at the door and expects to drop them into its existing manufacturing process, it may be disappointed with its initial results.”

The same challenges also extend to electrolytes. Wildcat explains that, in anode and cathode design studies, where they are typically varying the thickness and porosity of electrodes, it’s really important to test the different electrode designs with a variety of different electrolytes. Active materials from different suppliers – even if they are in the same general category like silicon – will often perform differently with different electrolyte variations.

Competitive edge and cost savings

The ultimate result of a comprehensive benchmarking study and true apples-to-apples comparison can be quite profound. If your company is testing thousands of cells in this type of optimization work, while everyone else is testing 20 or 50 cells in a standard lab, you could potentially discover a novel formulation with commercially available materials that gives you significantly better cell performance than others with the same access to those materials.

Also, reducing costs is always important in the automotive industry, and minimizing battery costs is vital to EV growth and profitability. True optimization of each material allows you to discover the most affordable solution. Imagine testing 10 material samples of an expensive active ingredient like a high-nickel cathode material. Each sample from different suppliers will have a range of purity and costs, and only when you optimize each to perform its best can you identify the most affordable solution that meets all the required performance specs.

Unlocking meaningful potential

Wildcat believes that the lack of rapid benchmarking techniques is inhibiting the battery industry in a few ways. “Material suppliers know that when they send samples of new products to customers, for the most part, it’s going to get dropped into existing manufacturing lines to be tested,” explained Strand. “This is actually one of the reasons why materials companies are often hesitant to try new things. They tend to look for more incremental improvements instead of going for the bigger breakthroughs that may require some recipe change or process optimization.”

On the other side of the same coin, Wildcat says the lack of widespread rapid benchmarking is also reducing the potential for incremental battery advances for materials that are already commercially available. “A lot of published research and conference topics focus on transformational efforts to solve really challenging things like solid-state, lithium-metal and lithium-air,” explained Jacobs. “Those are certainly more exciting presentations than citing modest improvements from benchmarking. However, very small incremental improvements for a sustained number of years lead to big advances in a technology, and there are a lot of very good materials already out there from which these small improvements can be derived.”

Source: ChargedEVs